April 2022

Summary

In today’s dynamic business landscape, seizing opportunities is key to growth. Enter Bitcoin, the gateway to global markets without boundaries. Unlike traditional payment methods like Visa, PayPal, or personal bank accounts, Bitcoin knows no borders, offering your business the potential for unparalleled exposure. Plus, it’s a cost-efficient solution that helps you avoid those pesky 1-3% transaction fees to middlemen.

With Bitcoin, anyone, anywhere in the world can effortlessly engage in transactions using a Bitcoin wallet, widely available for free across app stores and the web. It’s not just about convenience; it’s about securing a share of the future—a fraction of the digital, solid currency. This currency boasts a fixed supply, impervious to value-eroding inflation tactics.

Amidst the backdrop of a depreciating USD and other fiat currencies worldwide, integrating Bitcoin into your business strategy may be your beacon of hope. As Bitcoin’s fundamental strengths shine through, its purchasing power grows over time, offering a sanctuary from economic uncertainties.

Worried about the learning curve? Fear not. Competitive payment provider models make integrating Bitcoin payments into your online store a breeze. You can onboard with ease, limited risk, and peace of mind as you delve into this thrilling new frontier.

And here’s the cherry on top: Lightning Bazaar is offering an incredible 6-month free trial. Interested or have questions about integrating Bitcoin payments into your site? Simply fill out our form, shoot us an email at info@lightningbazaar.com, or reach out to us on Twitter @BazaarLightning. Curious to see Bitcoin and Lightning payments in action? Check out our store today.

Difficult Times for Businesses

I don’t believe there is anyone left on this planet who wouldn’t agree that consumer prices have risen massively over the last 2 to 3 years. Businesses have clearly struggled with rising costs in energy and real estate driving up the price of their goods and services. Very large businesses with economies of scale don’t feel the effects of these rises in costs compared to smaller businesses – many of which have had to cease operation in this difficult environment.

Inflation is literally killing businesses on the margin and there seems no near-term solution in sight. The purchasing power of US dollar and all other fiat currencies are consistently going down year over year. It is not uncommon across many developing countries where their currency is inflating away for businesses to quickly sell their local earnings and purchase hard assets. These assets could take the form of Gold, Silver, Lumber, Whitegoods, Paintings – even bricks – to store value over time.

Can you imagine the risk to holding cash for your business if, in a year it would be worth a say 50% in value? This occurrence across developing nations is also beginning to take hold right before our eyes in the West, with official figures well over 7% per annum in the US. So how to navigate these difficult times? Holding hard assets is obviously a good idea, however there is a real challenge with liquidity – that is, is the asset readily available to buy? Once you receive cash for your product or service, the time-critical task then becomes how quickly you are able to find a seller of these goods willing to accept your cash for them – the longer it takes the more it costs you. There are also issues with the asset decaying over time, in the case of metals (not gold of course ), lumber and white-goods.

So what else is there?

Bitcoin

Trying to put forward the case for why a business should hold bitcoin is something many others well before me have explained very eloquently (such as Michael Saylor and Saifedean Ammous) so I wont go into much depth. That said, a summary of the case is as follows:

1. Digital Hard Sound Money

Given the outline above, the case should already be made for holding a hard sound money – a money that’s not easy to create and does not get inflated away by some centralised authority making various decisions that inevitably results in the issuance of more units. And, being money one would expect it to be liquid – easily sold whenever needed. So we can see gold is a good fit based on this description. However, for these same reasons Bitcoin also meets the definition – but perhaps even more so – because unlike gold, Bitcoin is highly divisible. Each Bitcoin can be split into one hundred million units called Satoshis (after the mysterious founder). And it is also highly saleable over space. That is, value can be transferred to any person or entity in the word holding a bitcoin wallet – within minutes for smaller transactions and within hours for multimillion dollar payments.

This is thanks to the Bitcoin Blockchain – the ledger of transaction reaching consensus across the whole Bitcoin network on the state of all transactions that have ever taken place every 10minutes, or in other words, every block of approximately 1Mb of transactions. A transaction that sits 6 blocks deep from the top of the blockchain is considered irreversible, hence the 1 hour rule of thumb for significant sized payments.

You may see the immense value here in the settlement of transactions. This is magnitudes of order greater in efficiency when compared to achieving final settlement with “traditional” hard sound, money – Gold. The only way to settle gold beyond any doubt is for its physical delivery AND its recasting to ensure its purity. Clearly Gold cannot compete against Bitcoin in this arena.

2. P2P – The world becomes your oyster

As a business ideally you’d like to trade with anyone in the world. The reality is different countries have different rules when it comes to transacting internationally. Not everyone has Visa, PayPal or can carry out direct wire transfers. Many don’t even have a trustworthy or dependable bank account system. Bitcoin changes this. As long as you have an internet connection and a Bitcoin wallet application on your phone or your computer, then you can transfer value to anyone without the need to use a specific payment system or method. Where wire transfers may take days, with back and forth in confirming swift and bank account details, Bitcoin is settled seamlessly within 10 minutes (noting the additional wait of up to an hour if you really want to reduce risk to effectively zero for very large transactions).

The world becomes your oyster. You have access to a truly international market.

3. Save Transaction Fees with no middle man

Finally, there are the mechanics of the transactions, that is, how much is saved when transacting compared to traditional payment systems and methods? Completely accurate figures are hard to determine due to the many varying factors involved such as the advantage of being able to access markets traditional payment systems cannot, or the many different terms and agreements for commissions and fees set by payment service providers.

That said, generally when transacting in bitcoin, the blockchain or network “transaction fee” is paid by the user and can range from a few cents to several dollars, independent of the payment size. These are all nominal amounts – that is, they are unlike traditional payment service providers that take a percentage of each transaction. For example if you were to buy something worth $1000.00 the merchant may need to charge another 2% for the user paying via a credit card or PayPal – that’s another $20! The equivalent Bitcoin transaction would be as mentioned above in all likely hood under a tenth of that cost. To go another step further when paying with Bitcoin over the Lightning Network, fees are essentially zero (fractions of a cent)!

This opens the market for more competitive bitcoin payment service providers for business to choose from. Rather than a per-transaction commission of up to several percent, these new business models could offer flat-rate annual-subscription fees and or much lower percentage commissions.

So clearly there are costs that can be significantly reduced, which all adds up over time.

Given these three lenses in which we have viewed the benefits of Bitcoin payments integration, does this now mean going all-in and pricing every product and service in Bitcoin? Of course not. But I’d like to think it sets a foundation or strong case for some small percentage allocation.

Let’s run some numbers:

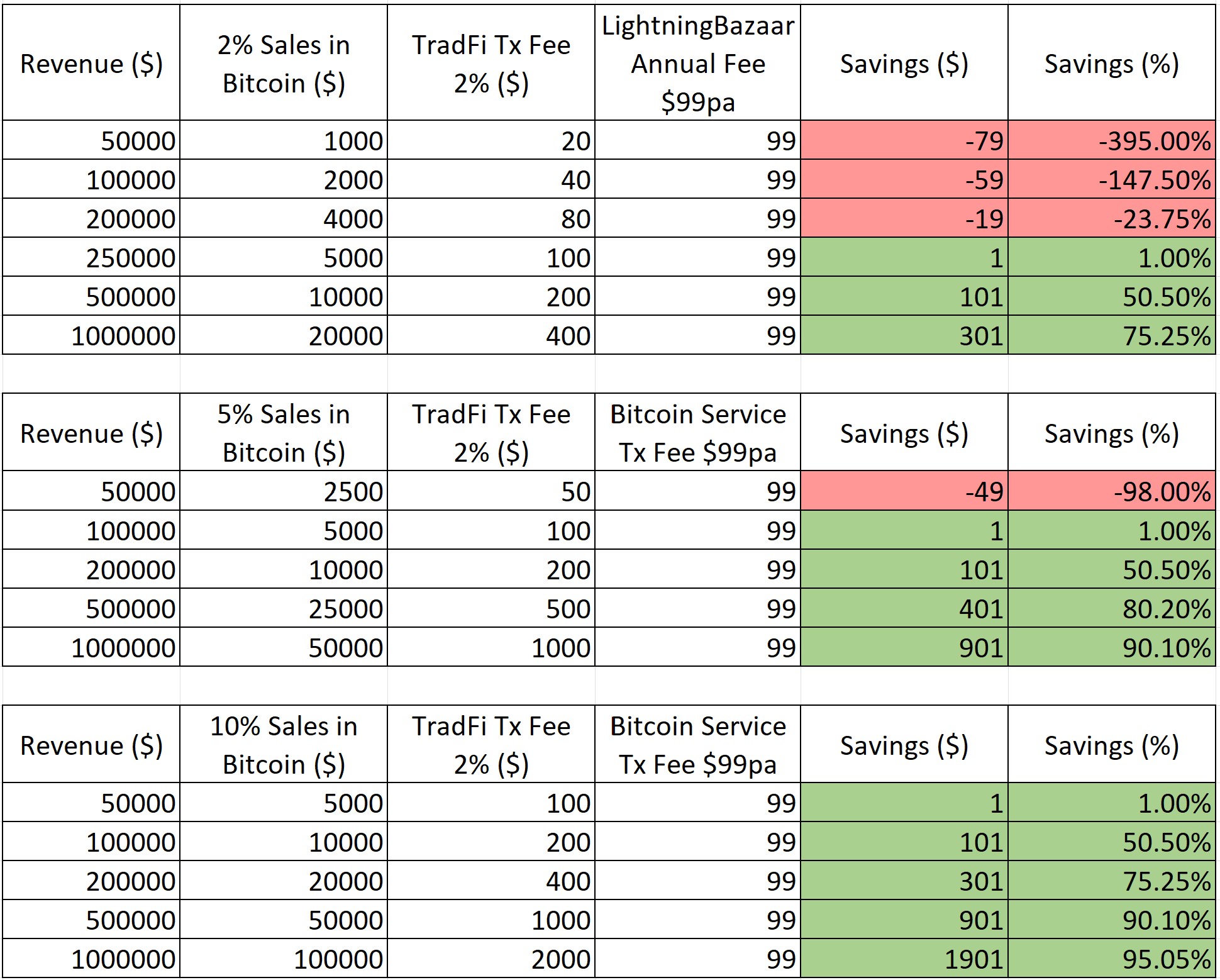

This is a very high level general analysis – obviously there are many different business models out there with different revenue streams, expenses, and profit margins. However, if we simply look at some scenarios in generating sales in Bitcoin we can form a basic cost-benefit picture.

Below we have three tables that represent 2%, 5% and 10% in yearly sales in Bitcoin for a Business. For example, in table one, if a business generates $50k revenue and 2% of that revenue was generated in Bitcoin, then that would be $1000 in Bitcoin sales. To make a fair benchmark for comparison we have considered the average traditional finance transaction fee cost for a merchant to be 2%. This may seem steep, but after research into Visa (1-2% including international), PayPal (2.6%) and Square (2.2%) for Credit Card/Online transactions an average of 2% seems reasonable. Perhaps at the very large end of town, some businesses would be able to negotiate cheaper transactions fees, however that’s not what is readily available on their websites. The fourth column in the table highlights our Lightning Bazaar Bitcoin Integration Service promotional offering which is $99 per annum. Yes, $99 – with zero transaction fees.

Say goodbye to ongoing merchant fees

Considering the 2% revenue table below the Break-Even point is where the fees generated on the sales in Bitcoin equal the fees normally paid as part of the traditional system. That is, $5000 in sales per year, or $417 per month.

Every additional dollar generated after this incurs no additional cost! Just not comparable to the ever increasing amount associated with a flat 2% rate for every transaction with many traditional payment methods.

Worst Case Scenario – cost of $99 for one year

What’s the worst case in terms of cost to a business that chooses to go with a Bitcoin implementation where they pay a third party for the service? Note that even though they pay a third party, only the business has access to their very own bitcoin wallet – not the third party. This concept is completely foreign to the likes of Visa and PayPal for instance, that have the ability to reverse, freeze or completely censor transactions. In regards to our Lightning Bazaar Bitcoin Payments Integration service, the business is only using the our infrastructure – a Bitcoin Node and software to send/receive payments. So understanding this context, the worst case would be a business signs up for a year’s use of Bitcoin infrastructure, pays the subscription fee and has zero sales in bitcoin. The cost here is the subscription fee – $99. This really is minimal considering the case we put forward earlier in that, you can transact with anyone in the world regardless of whether they have a bank account or not, no permission need – and you have the potential to stack a digital, hard, liquid asset with limited supply compared to fiat.

Bitcoin Crashes

There is another risk, perhaps highlighted more so in recent times – and that is where the price of Bitcoin drops sharply.

It’s not uncommon to see Bitcoin drop up to 80% from all time highs, whereby one would incur a significant loss if they choose to convert back to fiat. Therefore, if funds generated in Bitcoin are needed in the shorter term, say 1-2 years then being prepared to take a significant loss should not be ignored. However this article is written on the premise of one buying into the ethos of Bitcoin which would mean holding for several years. And while past performance doesn’t guarantee future gains, the Bitcoin fundamentals suggest an expectation of gaining purchasing power against fiat over the long term.

Even simulating $50 dollars in Bitcoin sales per month over the last 2 years where price has been in steady decline, interestingly does not produce significant losses as can been seen in the Dollar Cost Averaging (DCA) chart below. Remember, the opposite scenario is also possible where the Bitcoin price recovers and goes on towards new highs magnifying gains. Reality may sit somewhere in between.

How to enable Bitcoin Payments

If you have come this far you may be asking yourself the question – “how can I accept Bitcoin payments at my store?”

Well, if you have a WordPress site then its is very straight forward. Reach out to us to arrange registration followed by a few steps to link your sites to our Bitcoin Node then you will have Bitcoin payment enabled at check out alongside your existing payments. Again, you will be able to connect your own Bitcoin wallet – either by generating a new wallet in your account or connecting an existing one you already have. We will help you along the way.

No Obligation, Free 6 Month Trial

We understand it may take some time to become familiar with offering Bitcoin payments as well as needing the chance for your customers to be aware of your new payment method option. That’s why Lightning Bazaar is offering a free 6-month trial.

In the meantime if you would like to experience the check out process, including the option to pay with Bitcoin over the Lightning Network (excellent for micro payments) , check out our store.

If you have any question about integrating Bitcoin payments into your site please fill out our contact us form, send an email to info@lightningbazaar.com or reach out to us on Twitter @BazaarLightning.